I have been using Dave Ramsey’s Foundations in Personal Finance for Homeschool with my 9th grade son for a month.

Foundations in Personal Finance for Homeschool is a complete high school curriculum and meets standards and benchmarks in all 50 states. This homeschool edition has added scripture references that are not in the other editions of this curriculum. Foundations in Personal Finance for Homeschool sells for $119.99 for the set, with additional student texts available for $26.99.

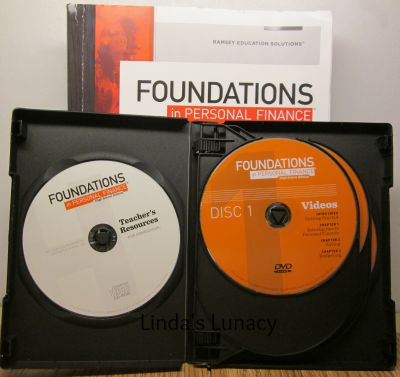

Included in Foundations in Personal Finance for Homeschool are the paperback student text and a 6 cd-rom set. Five of the cds feature teaching delivered via video by Dave Ramsey and his team of experts. The 6th cd is Teacher’s Resources.

Dave Ramsey’s Foundations in Personal Finance for Homeschool Review

Foundations in Personal Finance for Homeschool consists of 4 units.

Saving and Budgeting

Credit and Debt

Financial Planning and Insurance

Income, Taxes, and Giving

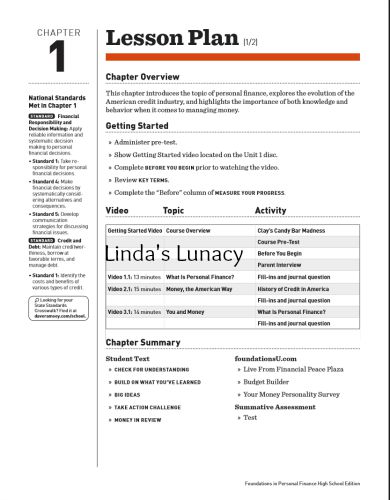

Each unit has 3 chapters, with each chapter containing 3 sections, as well as a chapter summary. You can see the chapter titles, summaries, and see a sample chapter from Foundations in Personal Finance for Homeschool on the website.

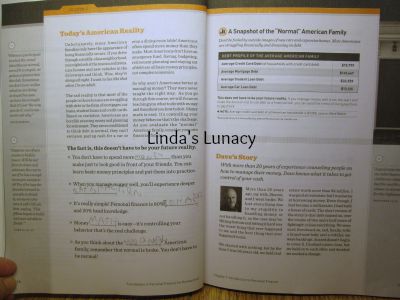

The student text pages are not in full color, but rather in shades of gray. The chapter and section titles are in orange. The pages are not boring, though. The book is filled with graphs, charts, statistics, quotes, and scripture references. Each chapter has journal questions. The chapter summaries help reinforce what the student learned in that chapter.

The video lessons last anywhere from 3 minutes to 15 minutes. My son said he really liked the videos. The instructors use humor and real life stories to teach and reinforce principles of managing money. While watching the video lesson, students follow along using the student text. As the student is watching the lesson, they have to fill in the blank in their book. I like this, as it helps to insure that my son is paying attention to the video lesson.

The Teacher’s Resources CD contains over 150 pages and includes a getting started guide, forms & resources, assessments, a 90 day syllabus, and files for each of the 12 chapters. Each chapter’s file contains a fill-ins answer key, lesson plan, chapter summary answers, case studies, printable activity pages, tests and answer keys. The over 35 activity pages contain fun activities that reinforce what was learned in that chapter. Some activities are about learning statistics about money. For example, which country has the highest, and the lowest, percentage of saving money.

I love having the syllabus printed out. I can tell with just a glance what is needed for each day. It makes it easy to have the printables ready for each day when the student needs them.

You are able to print out as many copies of the assessments and activities as you need for your homeschool students from the cd. The student text, however, does not grant permission to copy pages. So you will need a student text for each of your students.

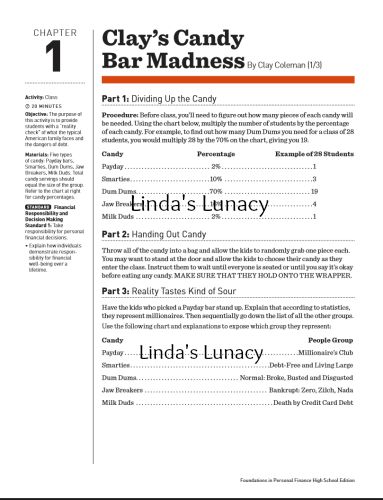

The only thing I didn’t like about this curriculum was that some of the activities were for the classroom, not the homeschool. For example, Candy Bar Madness, shown below, was designed to be used in the classroom, and is nearly impossible to replicate in the homeschool. This is something I think they need to improve. If they say this is for the homeschool, then all activities should be geared towards the homeschool setting.

There is another aspect to this curriculum that we have not used yet. There is a learning website available to the student that features calculators, tools and resources. We have not used Foundations U yet, but I have checked it out. The different calculators available look very helpful to the student. There are also articles to read, and the chapter activities for the course.

Overall, Dave Ramsey’s Foundations in Personal Finance for Homeschool is a great curriculum for teaching homeschool students all aspects of personal finance. From learning about world currency and the world financial market to the history of credit in America to saving their own money & managing a checking account and their own credit.

I’m pleased to be able to offer you a giveaway for Foundations in Personal Finance for Homeschool! Simply fill out the Rafflecopter form below to enter to win!

“Disclosure (in accordance with the FTC’s 16 CFR, Part 255: “Guides Concerning the Use of Endorsements and Testimonials in Advertising”):Choice of winners and opinions are 100% my own and NOT influenced by monetary compensation. I did receive a sample of the product in exchange for this review and post.

I’d LOVE to use this for my daughter! I’ve been wanting to get it but haven’t been able to shake the money free to do it.

Naomi recently posted..End of Summer Giveaway Hop

Money management is a life skill that all kids need. Unfortunately, most kids aren’t taught any of it! I want my kids to be prepared!

Tiffany recently posted..Halloween Kick-Off 2015 with the #OrangeTuesday Twitter Party

Love Dave and his programs. This would be a great addition to our home curriculum.

I don’t want my kids to live their lives in chains of debt.

We are in our 9th year of homeschooling. With our older boys we used various personal finance books but have recently looked into the Dave Ramsey curriculum. However, trying to be good stewards, we just couldn’t swing the extra cost this year. I would love to implement this with our 8th grader and also have our recent highschool graduate go through it too. Plus, I can imagine that I will be able to benefit from the curriculum as well!

I believe that kids learn so much in school with math, reading, writing, science, etc. However, kids do not learn how to make, manage, and budget money which leaves them vulnerable in the real world! I want my son to know how to manage, budget and make money. I want him to be confident in his money management; I want him to know how to save and not spend. I want him to not get caught up in this world of debt and overspending, I want him to be able to afford his own home, a car, go to college, and support himself (possibly his wife and family in the future). Now days, many children grow up to be irresponsible adults who play more than they work, they don’t save, they aren’t frugal and they end up renting their homes forever and are unable to actually purchase a house. I want to ensure that my son is well educated in something that is crucial in our lives, he spends so much time learning about many things he will never use in life and spends too little time not learning about things he needs to know in the real world; this would be the perfect tool to educate him and perfect timing as he is 11 years old =)

Ashley recently posted..End of Summer Giveaway Hop

I want my granddaughters to have every advantage academically

Would love to use this in homeschool to teach my husband and I to learn to be more responsible with money and pass that onto our children.

Kelly recently posted..Publix Flavor Excursion Sale & Giveaway

My husband and I have been through the Dave Ramsey Financial Peace course and it was very helpful to us. I would love to use this to teach my 9th and 11th grader how to handle money.

My daughter is in 8th grade….old enough now to start understanding money the Right way!

It would be great to teach my kids.

Financing is something everyone should learn at an early age! And who better to learn from than Dave Ramsey!!!

I’d love to use this with my teen daughters! I don’t want them to make the same mistakes I made as a young woman.

I think it is very important for kids to learn about finance from a young age. My parents and my husbands parents were very bad with finance. When we first got married we made a lot of financial mistakes that put us in debt. We are working to get out of that now. That is why I want to win this.

I homeschool my three children and would teach this course in our home economics class. It would be wonderful for them to better understand how their parents budget using Dave Ramsey finances.

I have a senior and a sophomore that need these skills before heading out into the “real world”. 🙂

My husband and I took the Financial Peace class and have also gone to a seminar. We have changed our habits and now, we are almost out of debt. I want to pass this on to my kids. This would be an awesome elective for high school.

Yes, I would love to use this for my girls in homeschool!

Perrsonal finance is something that everyone needs to learn!

This would be great to teach my children about personal finance.

I’d love to use this w/both my sons, one’s homeschooled, other’s public. I’ve heard really good things about Dave Ramsey’s finance courses but have yet to try them. Thank you for the giveaway.

It would be a great tool to use for my kids!

To give my kids a good foundation for the future when it comes to finances and maybe avoid some of the mistakes I have made

I am actually almost finished with the FPU class at our church that we’ve done throughout the summer. This would be a great chance to teach my kids so many of the awesome things Dave Ramsey has taught me!

This is a course I definitely want my kids to take! I feel that our nation is run on debt and that you have to teach the opposite if you expect not to live the same way.

Susan Evans recently posted..Modern History Notebook

My two kids will benefit from this sooo much!!!

This is a little advanced for our homeschool but I would be interested in reading it and saving it for a few years.

Wonderful giveaway! We can really use this!!!! Thank you for hosting this one!!!

It sounds like we could all learn a lot from it.